Archive for the 'Clerk Printed Labels' Category

Monday, June 22nd, 2015

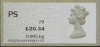

Following on from their introduction at Europhilex 2015, the latest design of Horizon Postage Label has now been seen in day to day use in operational (not event) Post Offices. The example shown is from Moorgate Post Office a few days prior to relocation of that office.

Leave Comment » | Posted in Clerk Printed Labels, Postage Labels

Tuesday, May 12th, 2015

At Europhilex 2015, as is usual with International Exhibitions in London, as well as the usual Royal Mail ‘Philatelic’ offering, an operational Post Office was established on the gallery. As part of this and similar to London 2010 where the now widespread ‘Gold’ Horizon had its ‘First Day’ , Post Office Ltd introduced the latest […]

Leave Comment » | Posted in Clerk Printed Labels, Postage Labels

Tuesday, March 31st, 2015

New NVI and OV stamps plus a Horizon label Monday 30th March 2015 – ‘Tariff Day’ , the day that Royal Mail change their prices. Some up and some down -including some significant drops in the Medium Parcel rates and penny or increases so most other rates. One of the main changes to interest to […]

Leave Comment » | Posted in Clerk Printed Labels, Customer Printed Labels, Dispensed Labels (ATM), Postage Labels

Tuesday, April 2nd, 2013

On 2nd April 2013 a new system of “Size Based Pricing” was introduced by Royal Mail. This resulted in the introduction of two new sizes and so new Horizon indicators – ‘Small Parcel” (1SP 2SP) and “Medium Parcel” (1MP 2MP) were introduced which replaced the ‘Packet’ Size (Both of which are available as either 1st or […]

Leave Comment » | Posted in Clerk Printed Labels

Saturday, December 1st, 2012

As we enter Advent the Hytech machines at Camden Pop-Up shop have a updated ‘Date identifier’ – with the Text String ‘rolling over’ to ‘ADGB12’ on the 1st of December. See post below for detail of the Hytech ‘Next generation’ Text String. Originally the Text String was ANGB12 and now is ADGB12. This means […]

Leave Comment » | Posted in Clerk Printed Labels

Wednesday, October 12th, 2011

On Monday 29th September 2011, two new ‘accounting codes’ were added to the existing printed overprint applied at the time of posting to the Horizon label. These codes are solely for the easy identification of the VAT rate/ product combination for each label, where a subsequent refund has to be made, ensuring any VAT is […]

Leave Comment » | Posted in Clerk Printed Labels, Postage Labels

Monday, September 26th, 2011

A change to the Horizon postage labels has taken place today, which has resulted in some additional codes being added to the overprint, to be used for Post Office internal accounting purposes for example it will be possible to identify which product a ‘SD’ label refers to – SD by 9, SD next day, SD to […]

Leave Comment » | Posted in Clerk Printed Labels, Postage Labels

Friday, April 22nd, 2011

In a widely expected change and to simplify the transaction, on Monday 18th April the Gold Machin Label identifiers ‘MOR’ and ‘RPR’ were discontinued. A new identifier ‘RSF’ was introduced for circumstances where a ‘Home Shopping Return’ requires a ‘Recorded Signed For’ add-on. This means that a max value of 77p is possible. For a […]

Leave Comment » | Posted in Clerk Printed Labels, Postage Labels

Thursday, March 3rd, 2011

We have now received the First Day Covers back from the handstamping centre from last weeks Stampex trial of Hytechs Postalvision equipment, which produces slightly different versions of the Machin Post and Go Stamp (detailed below) . These are available for purchase in our ATM shop as well as via Ebay.

Leave Comment » | Posted in Clerk Printed Labels, Dispensed Labels (ATM), Postage Labels

Thursday, February 24th, 2011

The Trial of Hytech “Postalvision” Post and Go kiosks is currently in full swing at the Spring Stampex in London. On the first and second days the two machines did brisk business with collectors keen to obtain examples of the unique Machin strips that were available.

Leave Comment » | Posted in Clerk Printed Labels, Dispensed Labels (ATM), Postage Labels

Pages (4): [1] 2 3 4 »