Horizon Label Accounting Codes-The Definitive Guide

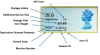

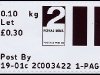

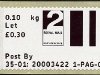

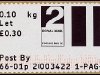

On Monday 29th September 2011, two new ‘accounting codes’ were added to the existing printed overprint applied at the time of posting to the Horizon label.

These codes are solely for the easy identification of the VAT rate/ product combination for each label, where a subsequent refund has to be made, ensuring any VAT is accounted for correctly.

There are 33 different “Royal Mail” codes and 4 different ‘Parcelforce’ codes- the table below shows the different codes that apply to each Label Identifier.

The ‘RM/PF ‘ Code maps to the Indicia- The ‘PPUK ‘Code maps to the VAT Rate.

How do I work out what VAT is applicable to my item?

The applicable VAT rate for a particular postal item is determined by its destination.

For items being sent inland or within the EU then most items are ‘Exempt’ –

However, some Premium services are Standard Rate -e.g.-Special Delivery Next Day where

any ‘Add-ons’ are applied (Such as Saturday Guarantee) plus Airsure and Parcelforce “Express” services.

Outside of the EU then items are ‘Zero’ rated (including the Channel Islands).

Example codes:-

Special Delivery’ – Next Day would be ‘y4’,

Next Day with Sat G’tee is ‘y6’ and

SD to Channel Islands is ‘y5’

Please do not copy this information without attributing the source – Copyright Postagelabelsuk.com 2011

Thank you for reading this post. You can now Leave A Comment (0) or Leave A Trackback.

Post Info

This entry was posted on Wednesday, October 12th, 2011 and is filed under Clerk Printed Labels, Postage Labels.You can follow any responses to this entry through the Comments Feed. You can Leave A Comment, or A Trackback.

Previous Post: New ‘accounting codes’ added to Horizon Postage Labels. »

Next Post: Post & Go ‘V2’ drops on Broadway SW1 »

- Review of the Post and Go Catalogue – First Class Machin Issues Without an Overprint

- Farewell to Parcelforce “OV” Stamps from Post Office Self-Service Kiosks

- New Post Office Self Service Postal Kiosk Unveiled

- The End of an Era: NCR Self-Service Kiosks in UK Post Offices and What’s Next for Stamp Collectors

- Europhilex comes to Birmingham in 2025

- New Self Service machines to be rollout at Post Offices

- Post and Go – The beginning of the end or the start of something new?

- Updated collectors strip from Jan 2021

- Royal Mail Brexit Tariff change 1st January 2021

- Post & Go…As you like it..